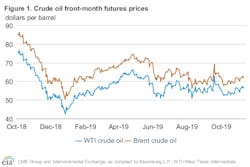

Crude oil markets traded in a relatively narrow range in October following heightened volatility in September stemming from the attack on Saudi Arabian crude oil processing facilities. Brent crude oil spot prices averaged $60/bbl in October, down $3/bbl from September and down $21/bbl from October 2018.

The front-month futures price for Brent crude oil settled at $62.29/bbl on Nov. 7, an increase of $3.40/bbl from Oct. 1. The front-month futures price for West Texas Intermediate crude oil for delivery at Cushing, Okla., increased $3.53/bbl during the same period, settling at $57.15/bbl on Nov. 7.

Some of the supply and demand-side risks that affected the global oil market participants in the third quarter have started to diminish, according to the US Energy Information Administrating’s latest Short-Term Energy Outlook.

Saudi Arabian production has returned to pre-attack levels. In addition, some of the expectations for lower economic growth-related oil demand may be receding and appear to be providing near-term support to crude oil prices at levels slightly higher than $60/bbl.

Some economic activity remains slower than in recent history—Chinese third-quarter gross domestic product growth, for example, was the slowest rate since at least 1992—yet, other economic indicators improved compared with those of a few months ago. Manufacturing Purchasing Manager’s Indexes (PMI) increased in both China and the US, and employment growth in the US continues to support domestic gasoline consumption, which EIA estimated to be at a seasonal record-high level in October.

In addition, the US Federal Reserve and other central banks recently signaled a more accommodating monetary policy, including lower interest rates, which could stimulate capital expenditures or other investment spending.

US commercial crude oil and other liquids inventories declined by 400,000 b/d in October. EIA estimates that global inventories increased by 800,000 b/d in October as inventory builds in other regions—some of which was likely the result of Saudi Arabia refilling stocks that it withdrew following the September production outage—offset the draws in the US.

EIA forecasts that this year’s fourth-quarter inventories will increase by more than 200,000 b/d followed by further inventory builds in the first half of 2020 that will put moderate downward pressure on crude oil prices.

EIA forecasts Brent spot prices will average $60/bbl in 2020, down from a 2019 average of $64/bbl. EIA forecasts that WTI prices will average $5.50/bbl less than Brent prices in 2020.

Based on preliminary data and model estimates, EIA estimates that US exported 140,000 b/d more total crude oil and products in September than it imported. In October, total exports exceeded imports by 550,000 b/d. If confirmed in survey-collected monthly data, it would be the first time that US exported more petroleum than it imported since EIA records began in 1949.

In its latest STEO, EIA expects total US crude oil and petroleum net exports to average 750,000 b/d in 2020 compared with average net imports of 520,000 b/d in 2019.