After setting a record in 2020, sales of Ethernet optical transceivers appear poised to set another one, according to LightCounting. Ethernet optics revenues in 2021 are set to exceed previous growth forecasts by 2X, the market research firm states in its September 2021 High-Speed Ethernet Optics Report. The jump start should enable an overall 15% CAGR from 2021 to 2026.

Last year’s sales of $3.7 billion represented an uptick of 34% from 2019, when the market declined by 18% (see "Ethernet transceiver sales to decline 18% in 2019: LightCounting"). LightCounting believes Ethernet optical module sales will reach $4.6 billion in 2021, a growth rate of 24% that is significantly better than the 10% figure LightCounting had predicted 6 months ago.

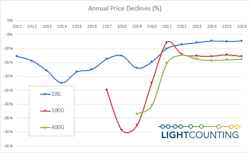

A few factors account for LightCounting’s optimism. One is increasing demand for legacy products (Gigabit Ethernet, 10 Gigabit Ethernet, and 40 Gigabit Ethernet) after such pull softened in the second half of 2020. The market research firm believes the demand pull comes from enterprise and telecom network upgrades put off during the pandemic. Another is relative stability in module pricing. After declines of 40% to 50% in 2018 and 2019, price reductions for 100 Gigabit Ethernet devices appear to have settled (for the time being, anyway) at around 10% -- as have declines for Ethernet devices generally (see figure above).

LightCounting points to supply chain shortages and higher prices for semiconductors as one explanation for the easing of pricing pressures. While these factors should be temporary, the market research firm nevertheless expects price reductions to hover around 12-15% on average 2022 through 2026. LightCounting views such rates as consistent with historical averages, putting 2018-2019 aside.

A third reason for sales jumps is increased demand for 200GbE FR4 transceivers from Facebook in 2022-2023 and 200GbE SR4 modules deployed by Alibaba, Tencent, and other Chinese cloud companies over the next 5 years. Meanwhile, LightCounting also increased its forecast for 400G transceiver demand. Devices such as 400G SR8 and 400G DR4 products have seen higher-than-expected sales in the first half of the year so far. LightCounting also notes that 400G SR4 transceivers were unveiled at CIOE 2021 by at least one major supplier.

The complete report is available to LightCounting subscribers.

For related articles, visit the Business Topic Center.

For more information on optical modules and suppliers, visit the Lightwave Buyer’s Guide.

To stay abreast of fiber network deployments, subscribe to Lightwave’s Service Providers and Datacom/Data Center newsletters.